defer capital gains tax canada

How To Defer Capital Gains Tax In Canada. Without deferring the earnings youd owe approximately 24480 in taxes in the first year recognizing your earnings plus the full capital gain in that first year and about.

How To Defer Capital Gains Tax On Real Estate Canada Ictsd Org

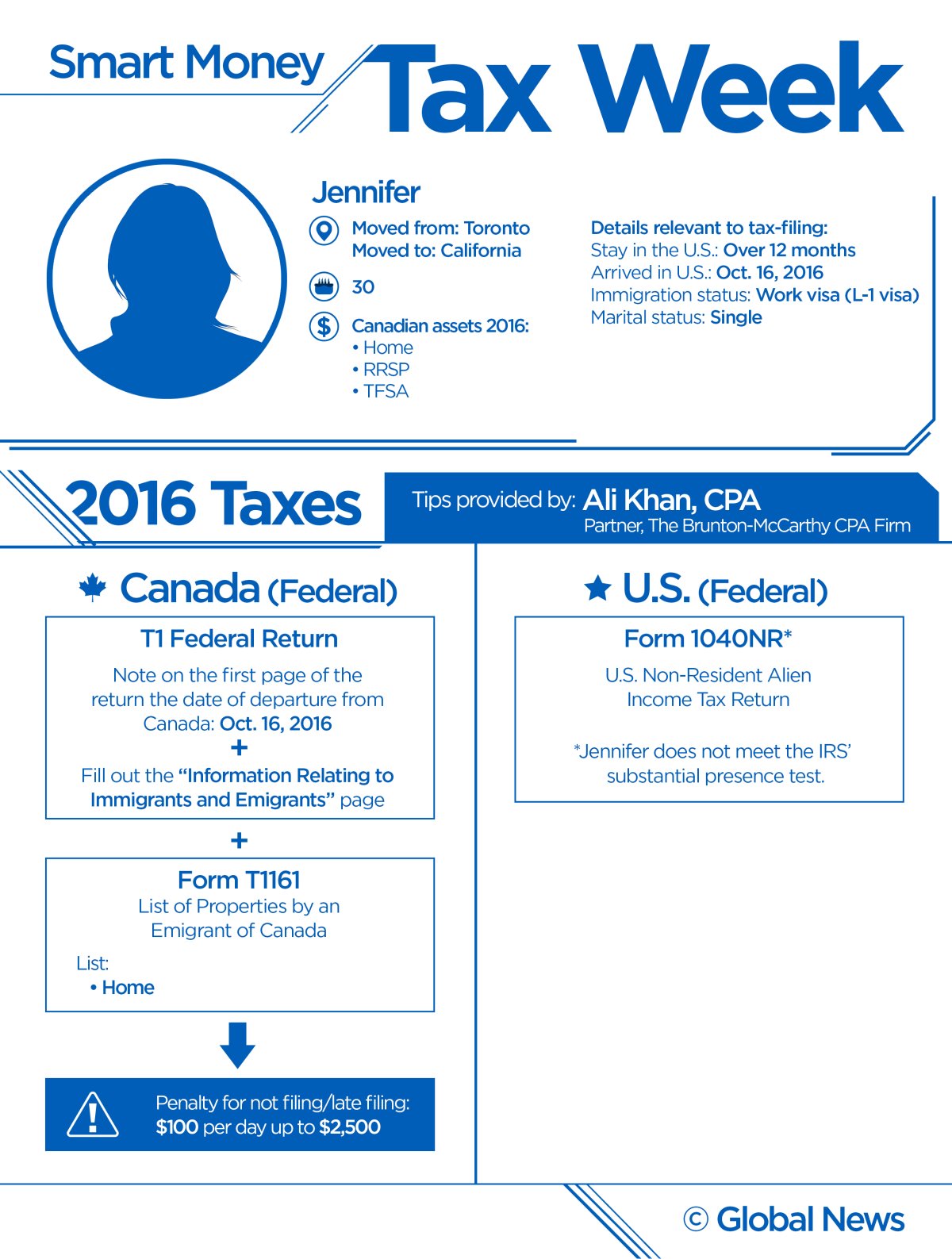

Capital gains may be claimed if you are resident of Canada.

. When you sell a capital property you usually receive full payment at that time. Schedule 3 must be filled out and filled out with your completed tax return for the year in which. The 1031 Exchange offers investors the chance to purchase rental properties and utilize it for resale.

Capital gains deferral for investment in small business. If your activity with respect to a property is in the nature of an investment as opposed to a business the gain on the sale of the property will be taxed as a capital gain ie. Capital gains can be claimed on a tax claim if your residence is in Canada.

And the tax rate depends on your income. How Long Can I Defer Capital Gains Tax. For more information on capital gains and losses go to Line 12700 Taxable capital gains Footnote 1.

It is required that the form T-2017 page 3 in schedule 3 be submitted. So if your spouse bought. Individuals other than trusts may defer capital gains incurred on certain small business investments disposed of in 2021.

For a Canadian who falls in a 33 marginal. Can You Defer Capital Gains On A Rental Property Canada. If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years.

In Canada you only pay tax on 50 of any capital gains you realize. Replacement property tax rules permit farmers to defer capital gains tax until the subsequent disposition date of the newly purchased property. The election provides farmers.

The sale price minus your ACB is the capital gain that youll need to pay tax on. This article briefly explains the treatment of capital gains deferral for investment in small businesses under the Canadian tax law. In our example you would have to include 1325.

In Canada can you defer capital gains tax by re-investing the capital gain back into more real-estate like they are able to do in the States. You can defer paying capital gains tax for your shares only when you got them from a spouse or parent due to death or divorce. How Long Can You Defer Taxes In Canada.

No you cannot defer capital gains tax by selling your existing property and then buying another property within 3 months of the sale. There are only fifty-percent taxes on capital gains in Canada which means of 100000 fifty percent will be taxable meaning 50000 will be taxedYour 50000 personal. There are six ways to avoid capital gains tax in CanadaThe tax shelters serve as a place to keep money and to file taxesLosses in capital are offset by capital gainsIncrease capital gains over previously realized amountsThis.

You should lower the amount. In Canada 50 of the value of any capital gains is taxable. Since 2001 all capital gains are taxable in.

Capital gains deferral B x D E where B the total capital gain from the original sale E the proceeds of disposition D the lesser of E and the total cost of all replacement shares. For example you may sell a capital. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

If you use all or more of the proceeds from selling the shares in your business to buy new qualifying investments you can defer 100 percent of your capital gains. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep. Canada does not have capital gains tax.

However sometimes you receive the amount over a number of years. Comments for Deferal of capital gains. For dispositions in 2021 report the total capital gain on lines 13199 and 13200 of Schedule 3 and.

You can only deduct an allowable capital loss from a taxable capital gain.

How Do I Report Capital Gains In British Columbia

The Tax Free Savings Account Tfsa Is One Of The Best Investment Vehicles Available To Canadians But Most Peop Tax Free Savings Savings Account Savings Chart

Validita Scrittura Privata Non Registrata Tax Accountant Small Business Accounting Auditor

Can You Defer Capital Gains Tax Canada Ictsd Org

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Capital Gains Tax Calculator For Relative Value Investing

How To Avoid Capital Gains Tax On Real Estate Canada Ictsd Org

Turning Losses Into Tax Advantages

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Pay Less Tax On Your Capital Gains The Independent Dollar

6 Ways To Avoid Capital Gains Tax In Canada Reduce Capital Gains Tax Canada Youtube

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Savings Hierarchy Savings Strategy Financial Planning Hierarchy

Turning Losses Into Tax Advantages

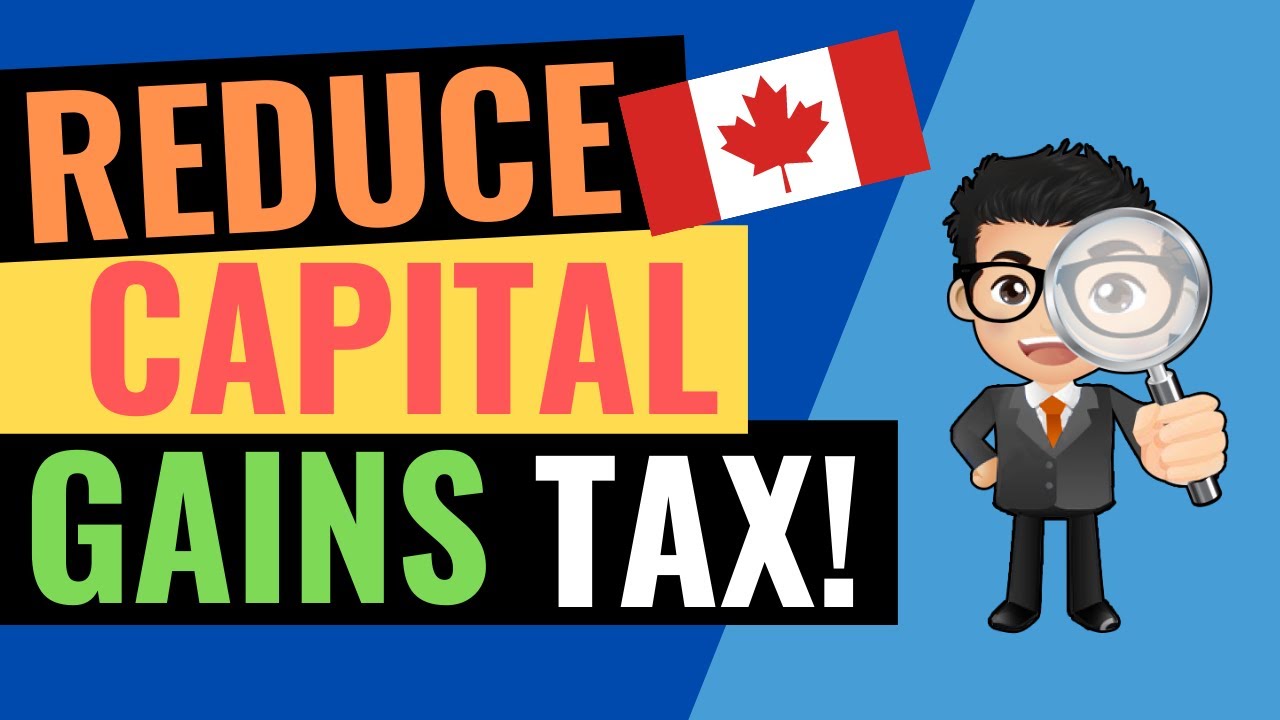

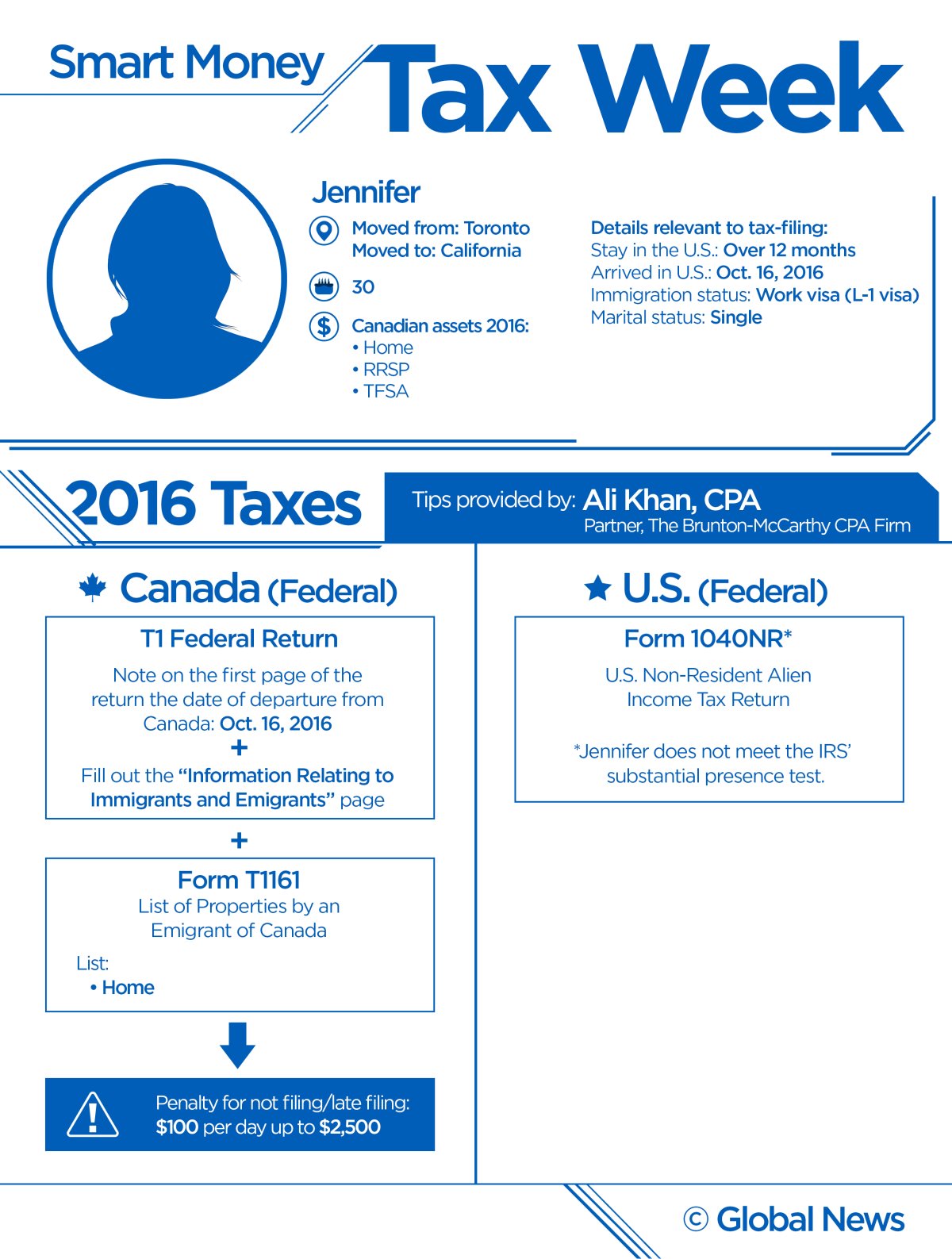

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca

High Income Earners Need Specialized Advice Investment Executive